Financial information

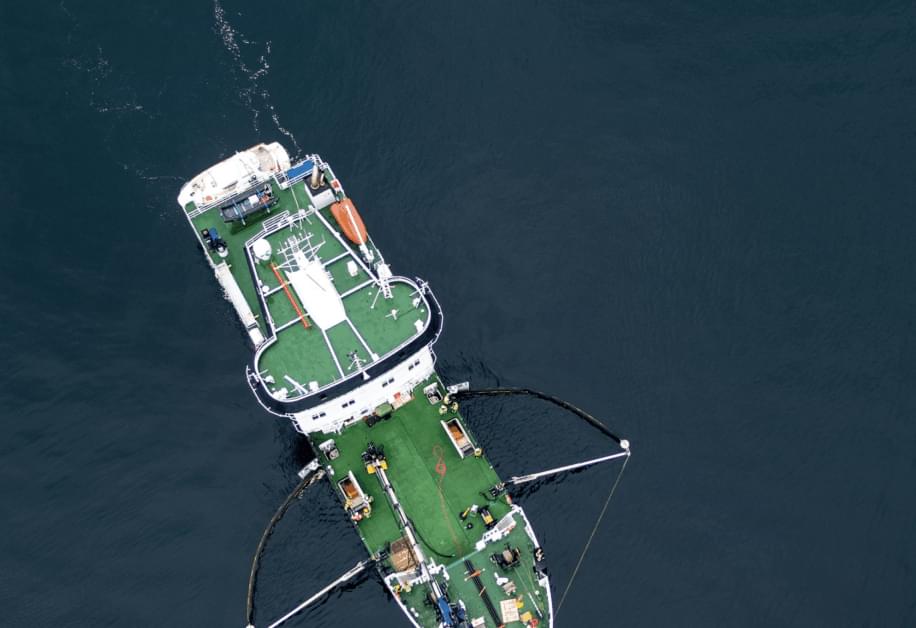

Lamor Financial Statements Release 2024: A strong cash flow during the fourth quarter

06 Mar 2025

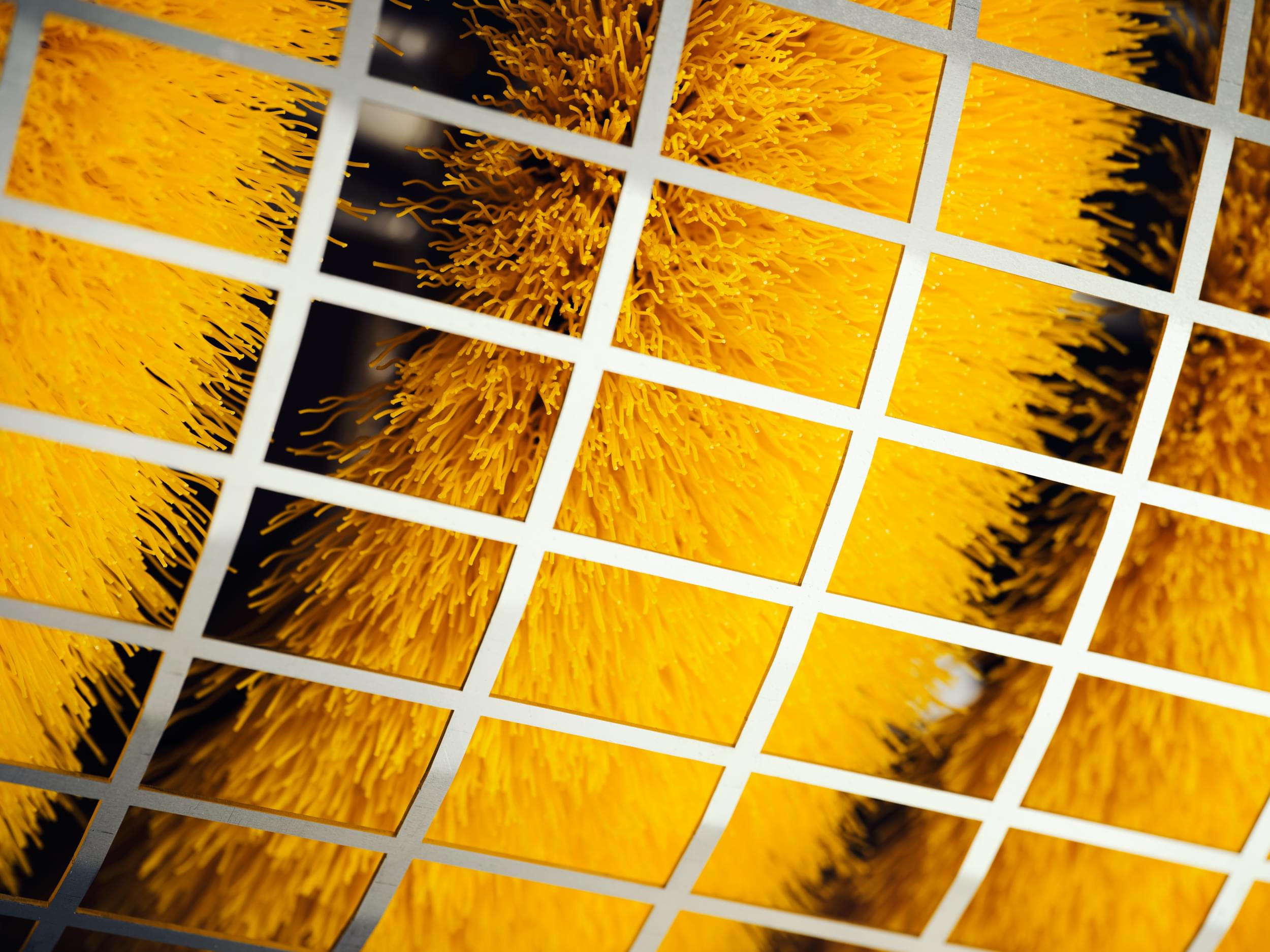

Lamor's determined efforts to reduce working capital were reflected in strong cash flow in the fourth quarter. Revenue and profitability increased from the previous quarter, but for the full year, the company still fell short of its targets. In Lamor's updated strategy, operational and sales resources are more rigorously focused on those markets where the greatest opportunities for profitable growth are seen. Investments are primarily directed towards initiating the plastic recycling business, where the company sees significant long-term potential.

Click below to find the complete report:

Lamor Financial Statements Release 2024

October–December 2024 in brief

- Revenue was EUR 32.6 million (34.8), a decrease of 6.3%

- EBIT was EUR 1.7 million (3.0) or 5.1% of revenue (8.7%), a decrease of 45.5%

- Adjusted EBIT was EUR 2.4 million (4.4) or 7.5% of revenue (12.6%), a decrease of 44.1%

- Net cash flow from operating activities was EUR 32.2 million (2.3)

- Net working capital decreased by EUR 28.9 million euros during the quarter, amounting to EUR 54.8 million euros at the end of the period (62.2).

- Earnings per share (basic) was EUR -0.02 (0.01)

- Orders received was EUR 15.9 million (10.0), an increase of 59.2%

- In October-November, Lamor announced a renewal of its management team to strengthen local customer and market understanding

- In December, the company published an updated strategy and long-term financial targets

January–December 2024 in brief

- Revenue was EUR 114.4 million (122.5), a decrease of 6.6%

- EBIT was EUR 5.3 million (8.4) or 4.6% of revenue (6.9%), a decrease of 36.9%

- Adjusted EBIT was EUR 6.4 million (11.3) or 5.6% of revenue (9.2%), a decrease of 43.6%

- Net cash flow from operating activities was EUR 16.6 million (-12.7)

- Net working capital decreased by EUR 7.5 million euros during the financial year, amounting to EUR 54.8 million euros at the end of the period (62.2).

- Earnings per share (basic) was EUR -0.06 (0.09)

- Orders received was EUR 80.9 million (44.0), an increase of 84.2%

- Order backlog at the end of the period amounted to EUR 88.0 million (124.2)

- The figures in brackets refer to the comparison period, which is the same period the previous year, unless otherwise stated.

Guidance for 2025

- Revenue is expected to increase compared to the previous year (2024: EUR 114.4 million).

- Adjusted operating profit is expected to increase compared to the previous year (2024: EUR 6.4 million).

Stay in the know

Sign up for our newsletter to learn more about innovations enabling the survival of our dear planet.