Nasdaq Green Equity Transition Designation

Lamor was the first Finnish company to receive Nasdaq Green Equity Designation in January 2022. The annual review was made in January 2023 by an external reviewer and Lamor continued to meet the criteria of the designation. The assessment in 2024 established that Lamor no longer met the criteria of Green Equity Designation, since the share of the red revenue exceeded the 5% limit determined in the programme. This led to Lamor’s application to Nasdaq Green Equity Transition Designation, which was granted in May 2024. The designation supports equity issuers with their green business models and strategies and enhances increased visibility and transparency toward investors looking for sustainable investments.

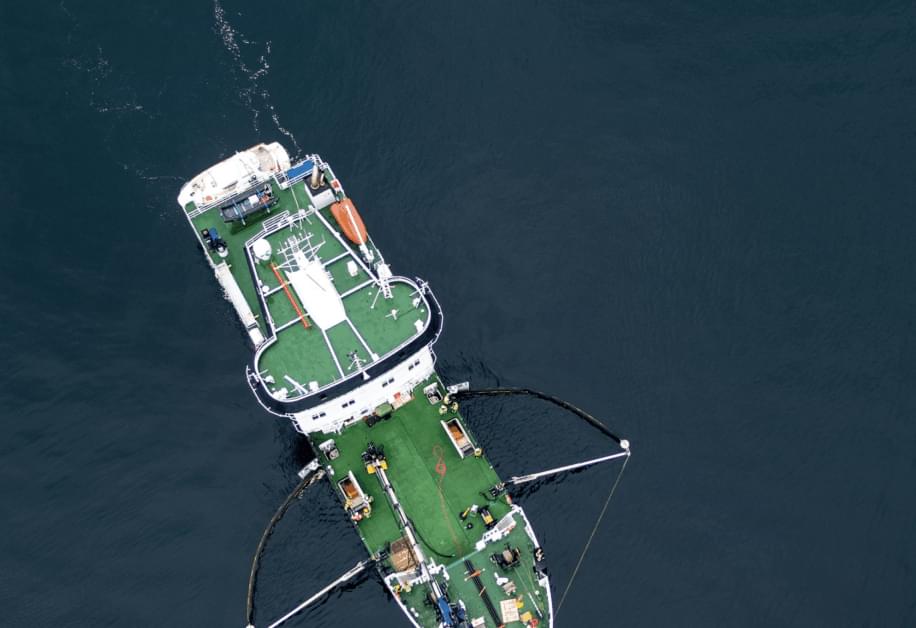

Nasdaq Green Equity Transition Designation are attainable for companies that have more than 50 percent of its investments allocated to activities considered green. There is no minimum threshold for turnover from activities considered green, but the company’s turnover derived from fossil fuel activities must be less than 50 percent. Lamor has a significant amount of green revenue (2023: 92%) but since Lamor is providing services to the oil companies as well, clean-up of oil spills has increased the amount of red revenue of Lamor and thus Lamor no longer meet the criteria for the green equity designation. To show that Lamor is committed to the green business models, Lamor applied and received the Green Equity Transition Designation in May 2024.

Shades of Green assessment 2023 Shades of Green assessment 2021

“Sustainability is at the core of Lamor’s mission 'Let’s clean the world'. Joining the Nasdaq Green Equity Transition Designation supports our strategy and business activities around sustainability, to further continue investing in the green business models and solutions” says Johanna Grönroos, Chief Strategy Officer of Lamor.